Hi all. This is the first piece I’ve written for our new company, Active Options Investing (ActOpt.com). In doing so I wanted to accomplish two things. The first being to keep things relatively brief! Something which has been difficult for me to achieve historically. The second and much more important goal is to do what I can to PREVENT it from happening again.

Recall the late 1990’s if you will. Stocks were roaring higher on “panic buying”, the fear of “missing out” was prevalent. The major indices were notching record daily closes routinely and CNBC was pumping as much helium into the bubble as they could muster (Some things never change!). Alan Greenspan was saying one thing on the one hand and squirting lighter fluid onto the fire with the other hand. Those were the days.

Now let’s zoom into late 1999. I attended a party where I encountered a guy that I once worked with during my college days many years earlier. The usual talk ensued but eventually, after I mentioned that I was trading options on the PHLX floor, he revealed to me that he had become a millionaire. After congratulating him, I asked him how he’d done that so quickly. He was quite a few years younger than me and I knew he couldn’t have been working a professional job for very long. He clarified things by relating to me that the stock options he was given, upon taking a lower-level sales position at Worldcom, had shortly thereafter made him a millionaire, at least on paper. Coincidentally I had been charting Worldcom for some time and suspected that, after having gone parabolic, it may have been about to break its long term uptrend. I brought this concern and others to his attention and explained that he could initiate a very low-cost to no-cost options strategy to fully protect his “millionaire status”. I implored him to call me very shortly and to not hesitate in considering things.

He got back to me about a week later. His “boss” had assured him that I was worried over nothing. Worldcom stock would only be worth more and soon enough. His family was also unconcerned. Something like “My parents think you’re looking to help for commissions” if I recall correctly. I explained to him that floor traders do not earn commissions and that I wasn’t a broker but before I finished my response I could tell that the door was shut completely. I told him if he ever changed his mind I’d be happy to help. You’ve probably guessed the end of this story by now…

About a year later, after trading near $60.00 per share, the stock was trading in the teens on its way to $0.00.

Traveling back in time just a little bit, a little after the initial Worldcom discussion, my brother-in-law asked me to help him out with his 401k when he visited for Christmas. He’d done very well in 1999 as the DOW was up around 25% that year while his portfolio was up 30%. However, he was “frustrated” he explained. The other guys at work were “busting his _____” because they were heavy in the “NAZ” (NASDAQ) and their performance had “crushed” his. Pointlessly I tried to caution him from going full throttle “NAZ”, as he called it, at the very end of 1999. I bothered to explain that he’d gotten great performance from the “blue chippy stuff” he was in that year. I wasted more time trying in vain to convey just how much of a bubble I believed the NAZ to be at that juncture. ONE minute after finishing my incredibly persuasive concluding remarks, I was helping him switch 100% into the NAZ at his “egg noggy” insistence. You already know how this story ended…

Finally, in late 2007, after working with our clients all year at Options University, we had established enough credibility to persuade many to hedge or at the very least to aggressively roll their options positions. A year later at our investors’ conference, dozens of people approached us to thank us for doing our small part to encourage them to be prudent with their life savings. That was a great feeling but soon after it struck me how many others were still clinging to “buy and hold” and how tragic that could become.

Now we’re in late 2016 and the second longest bull market in US history remains technically intact.

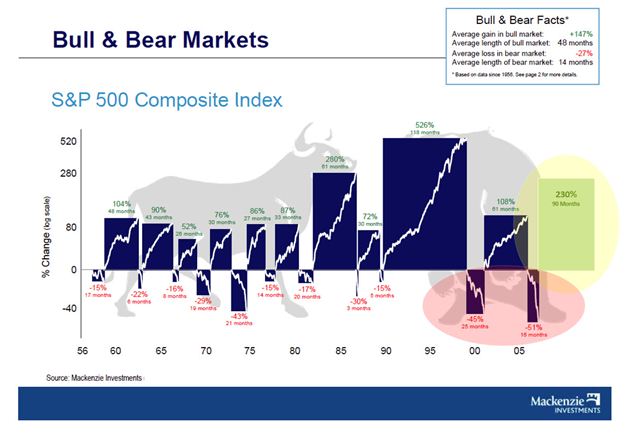

I found this graphic from Mackenzie Investments and I modified it a little to highlight the current bull market and the two prior bear markets.

Please note the following:

The bear market that started in 2000 resulted in a 45% decline in the S&P 500. The 2008-09 bear market crushed the S&P 500 for 51%. These results alone should make it clear that “Buy and Hold” is one bumpy ride. Worse, it’s an unnecessary one at that but that discussion is for another time.

My main point is that this current bull market is 90 months old and counting. It is the second longest one on record and could double the average length of a bull market in about 6 months. This bull is approaching the outer regions of the bell curve of durations.

NOW CONSIDER THIS: There’s probably never been a more RIGGED stock market in our history. There’s also never been one so dependent on FED and Government support and a dash here and there of prestidigitation! There’s also never been on more disconnected from economic realities, both real-world statistically and via the “eye test” when applied to Main Street USA. This and many other factors all add up to “potential for serious trouble” at some point but the “when” factor, as usual, is always elusive.

History doesn’t have to repeat itself. I mean this in a few ways. First off, at this snapshot in time, I’m technically bullish so please don’t take this as a call for a crash. A crash can happen at any time even with good technicals in place but short of a catalyst, I’d have to state that my cycles work suggests a slight edge to be had by the bulls in the near future. I also suspect that the FED will invent some new scheme to prop up equities markets well before they fall 50% but one can never know…

And that’s the point. If people only had the know-how, they could invest in these crazy markets, permanently avoid devastation and sleep well every night. It’s not that hard to understand, it doesn’t take that long to learn it and use it, and at our company, it doesn’t cost that much.

We look forward to assisting investors as they invest in themselves.

Cordially,

Wayne Razzi

Co-Founder

Active Options Investing